Forecasts about the near future of the Spanish and even international economy, they are not too hopeful, even more so, when we are not finished recovering from the effects of the previous economic crisis. It is foreseeable that, with these forecasts, the unemployment rate rises again, defaults, the difficulties to face the credits etc…

In this situation it is important to take into account the provisions of the Royal decree law 1/2015 from 27 February, second chance mechanism, reduction of financial burden and other social measures, who introduced the article on 178 bis of the Bankruptcy Law (BEPI), where the “Benefit of exoneration of the unsatisfied liability” is contemplated, commonly known as "SECOND CHANCE LAW"

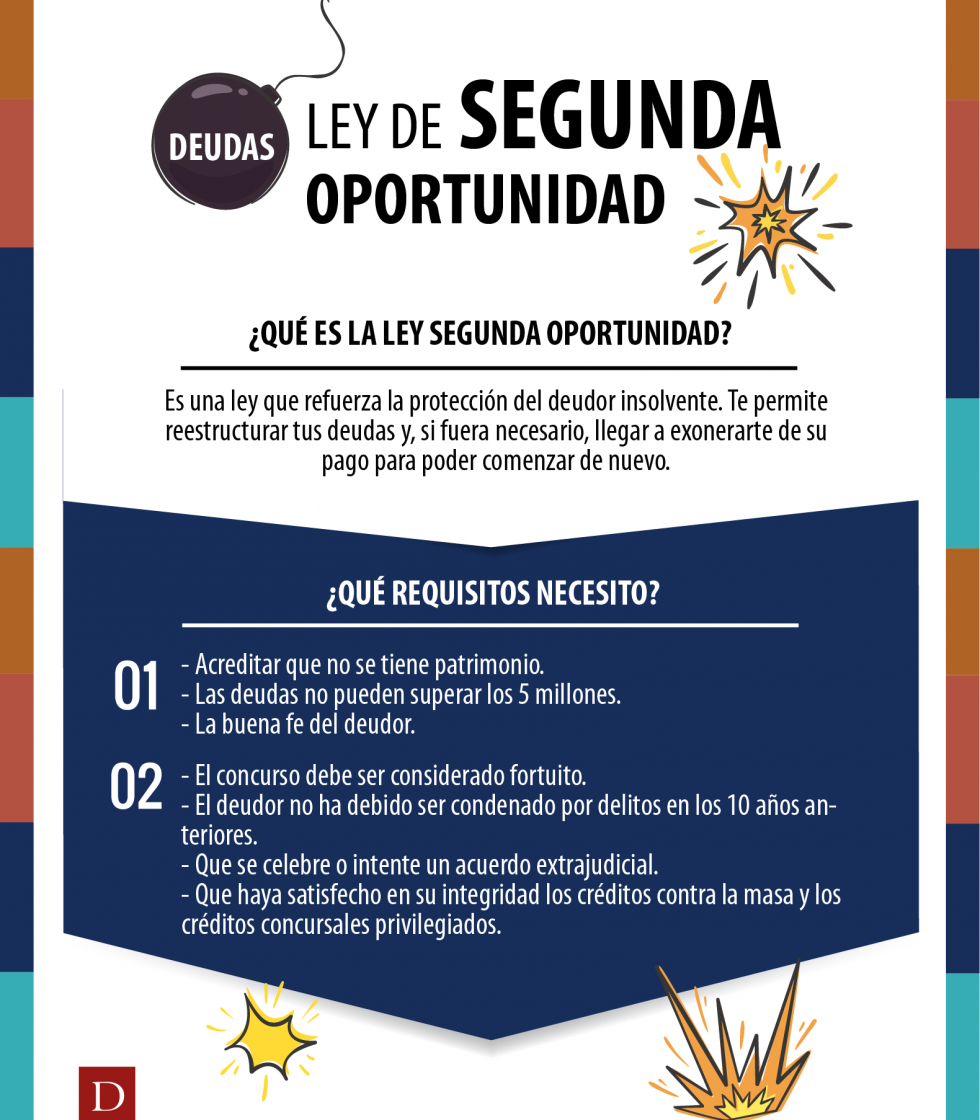

WHAT IS THE SECOND CHANCE LAW?

Second chance mechanisms, they pretend, in a bad financial situation, set a limit at the beginning of universal financial liability, that regulates in the article 1.911 of the Civil Code.

The second chance law was issued in a delicate economic situation and came to reinforce the protection of the insolvent debtor. In this situation of need, the second chance mechanism allows you to restructure your debts and, if necessary, get to exempt you from your payment to be able to start again. Let's say it is the equivalent to a bankruptcy proceeding of legal persons, but in the field of natural persons.

However, it is not about leaving creditors' collection rights abandoned and therefore a series of limits and guarantees are established that require the legally established requirements to be able to avail yourself of this mechanism.

REQUIREMENTS TO ACCEPT THE SECOND OPPORTUNITY LAW

In first place, and as initial conditions to be able to consider starting the procedure, three requirements:

- Prove that there is no equity to face the debts or that it has already been settled.

- further, the total obligations debts may not exceed in any case the 5 millions of euros.

- The debtor's good faith.

Secondly and in relation to the good faith of the debtor, Article 178 bis of the Bankruptcy Law in its section 3 indicates the requirements:

- The contest must have been classified as random.

- The debtor should not have been convicted in a final judgment for crimes against property, socioeconomic order, documentary falsehood, against the Public Treasury and Social Security or against the rights of workers in the 10 years prior to the declaration of the contest. If there is a pending criminal process, the judge must suspend his decision until there is a final judgment..

- That an out-of-court settlement had been concluded or at least attempted.

- That he has fully satisfied the claims against the estate and the privileged bankruptcy claims and, if you had not tried a prior out-of-court settlement, at least, the 25 percent of the amount of ordinary bankruptcy credits.

If this last point is not fulfilled, could be replaced by the following:

- That the debtor agrees to submit to the payment plan.

- That he has not breached the obligations of collaboration with the bankruptcy administration and the judge.

- That you have not obtained this benefit (the one with the second chance) within the last ten years.

- That you have not rejected within the four years prior to the declaration of bankruptcy an offer of employment suitable to your capacity.

- That you expressly accept, in the request for exoneration of unsatisfied liabilities, that the obtaining of this benefit will be recorded in the special section of the Bankruptcy Public Registry with the possibility of public access, for a period of five years.

THE EXTRAJUDICIAL PAYMENT AGREEMENT

As we have been able to verify, one of the essential requirements to be able to accept the Second Chance Law, is that an out-of-court payment agreement had been concluded or at least attempted.

Thus, the first step and with the intervention of a bankruptcy mediator, must be try to renegotiate debt conditions with creditors. During the settlement, a payment plan and schedule must be proposed so that the debtor can face the debts. The negotiation process may last, at most, two months.

The objective of this step is to safeguard the rights of creditors creditors, giving the possibility that they will receive some payment in the future.

EXEMPTION BENEFIT OF UNSATISFIED LIABILITIES (BEPI)

In the event that the out-of-court payment agreement does not come to fruition or is not accepted by creditors, would give way to the consecutive Contest, and the “BEPI” would come into play. Thanks to it, the debtor may be exonerated from non-privileged credits.

Leave a Reply