Introduction:

Taxation of the transfer of vehicles to employees, partners and members of the administrative body has been the subject of numerous discrepancies with the tax inspection, which has caused numerous administrative and jurisprudential pronouncements.

Following the latest rulings of the Court of Justice of the European Union (TWENTY), the National Court (AN) and the Central Economic Administrative Court (TEAC), the AEAT has issued an informative note on the criteria that should govern the Personal Income Tax (IRPF) and in the Value Added Tax (IVA) for the transfer of company vehicles to their employees, thus, with the publication of said note, The AEAT pursues a double objective: that taxpayers know the criteria that the Treasury will follow in future inspections and establish the criteria so that the inspection offices apply them uniformly.

Given this situation, we are going to expose the administrative criteria that the Inspection is following., for the transfer of vehicles, in the Personal Income Tax and in the Value Added Tax.

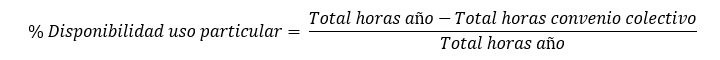

Remuneration in kind in personal income tax:

According to art. 42 of the personal income tax law, For there to be compensation in kind, there must be a demonstrable particular use.. In the event that this requirement is met and the remuneration in kind is received by an employee, The valuation will be as follows:

- In the event of delivery, the acquisition cost for the payer, including taxes that tax the operation.

- In the event of use, the 20% Yearly of the acquisition cost including taxes.

- In the event that the vehicle is not the property of the payer, This percentage will be applied to the market value that would correspond to the vehicle if it were new., although the entity has it via renting, is he 20% of the value of the vehicle if it were new.

further, establishes certain reductions for energy efficient vehicles, that will go from a 15% until the 30% in the minority, depending on the nature of the car.

Remuneration in kind must be add all expenses satisfied by the company that allow the vehicle to be put in conditions of use, such as insurance, repairs… On the contrary, los bills derived from the consumption of fuel will constitute a remuneration in kind separate as long as they are satisfied by the company.

One of the most significant changes is the modification in the methodology to establish the percentage corresponding to private use of the vehicle. For this, The AEAT establishes the “availability criteria”, which says the following:

"For it, It has been taken in consideration, for workers and managers, the working hours provided for in the collective agreement applicable to the company and the availability time for workers, completed on weekends, festive, vacations and non-working hours, on weekdays.”

In this way, the calculation of the deductibility percentage would look like this:

With the application of this formula, the average percentage that would be applied would be around 80% for purposes private and the 20% for use business, which gives a more than favorable result for the Administration.

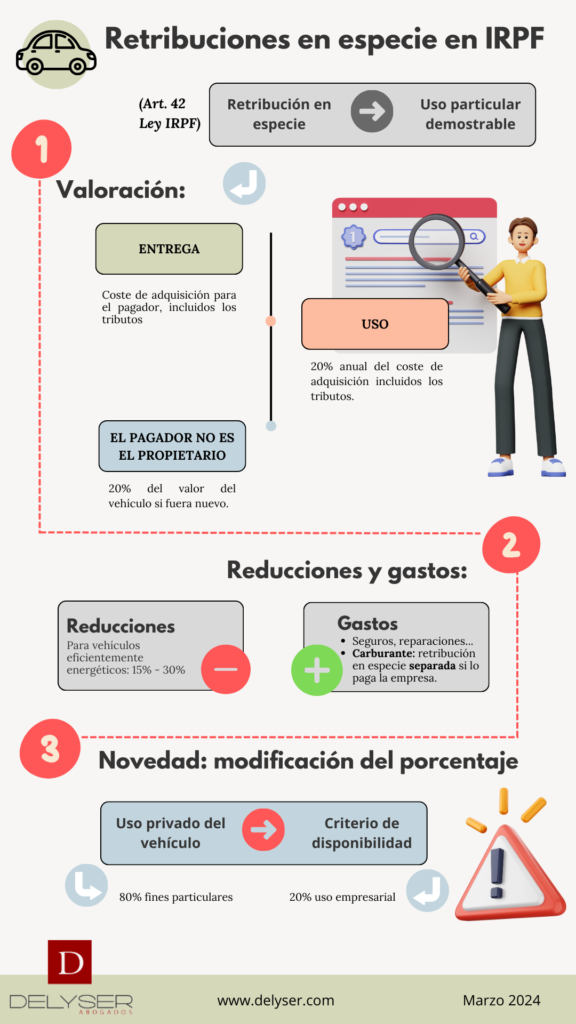

Remuneration in kind in VAT:

According to the CJEU, the assignments of vehicles are taxed with VAT only if they are made in exchange for consideration, that is to say, when there is a onerous exchange. To determine if there is onerousness, The AEAT establishes that it must be complied with or that the worker pay for use vehicle, what choose the vehicle among other various remunerations. In the same way, establishes gratuity when you don't have none repercussion in his remuneration. Thus, If the transfer of the vehicle is free, said provision of services is not subject to IVA.

Given this, the Supreme Court, last 29 of January of 2024 passed sentence confirming the criteria of the CJEU regarding the impact of VAT on the transfer.

Refering to deductibility of the VAT contributions incurred in the acquisition, we will have the following cases:

- And affects the entire vehicle to the company's activity, can be deducted 100%.

- cesion of the vehicle in its entirety for the private use of employees, with nature onerous: with will resonate the VAT for the assignment to 100%, and will deduct VAT to 100%.

- If it exists mixed transfer without onerous (free transfer with input VAT or lease) the impact will be partial, being able to apply the presumption of the art. 95.Three.2nd of the 50%. However, the AEAT can determine a lower percentage based on availability criteria.

- Mixed transfer with onerous: If VAT has been incurred on the acquisition, The asset will be subject to economic activity and therefore the entity will charge the VAT for the transfer.. If VAT is not paid by the recipient, It will be understood as greater remuneration in kind.

- Free transfer of the vehicle entirely to employees for private use: cannot be deducted anything VAT.

In summary, the percentage of impact will also be applied to the fee borne.

In relation to the self-consumption, the AEAT stipulates two situations:

- If when purchasing the vehicle was deducted 100% and then if you give in by way of free, is considered a provision of services and, thus, VAT must be charged.

- If it was partially affected to the activity and is subsequently transferred free of charge, percentage will be deducted corresponding to the condition, also taking into account that the Tax Agency may apply the availability criterion.

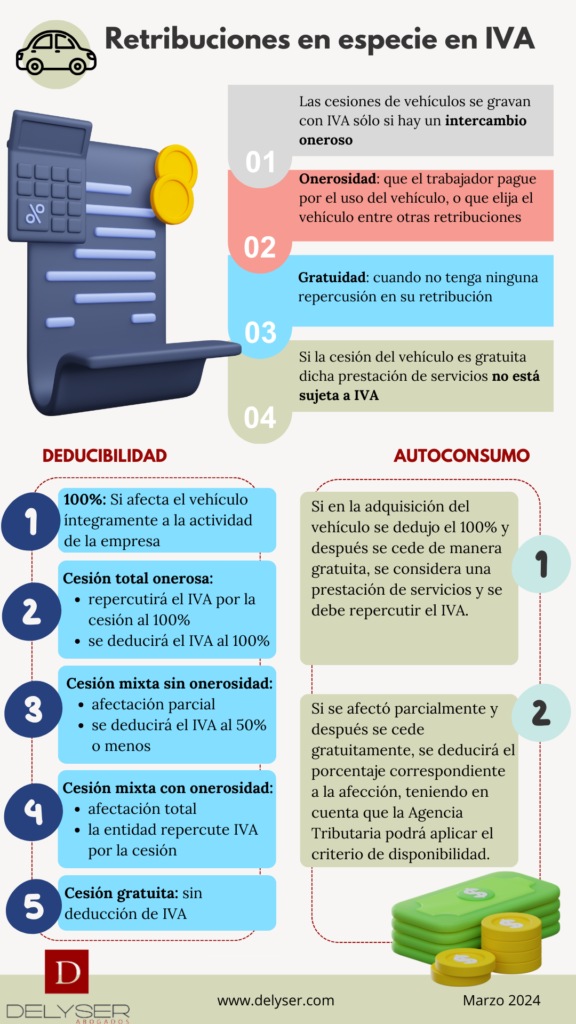

Tax base for VAT and personal income tax purposes:

Despite the fact that the AEAT Note assimilates the treatment in VAT and Personal Income Tax in terms of the degree of availability for particular purposes, it It does not imply that the base of both taxes is the same.

As for the IRPF:

- If the vehicle is company property, the base will be 20% of the cost acquisition including taxes.

- If the vehicle is not property of the company, the base will be 20% of market value.

As for the IVA:

- If the vehicle is property of the company, The tax base will coincide with the market value of the transfer.

- If the vehicle is used in lease regime, the base will coincide with the lease fee.

Conclusion:

Definitely, The Note issued by the AEAT allows companies to know with certainty the criteria applied by the Administration in the verifications. A due diligence exercise forces companies to evaluate their position in this regard. This evaluation will begin by determining those points in which the decision made by the company diverges from that maintained by the Administration..

Potential areas of regularization known, The company must analyze whether the tax treatment it is applying is duly supported or if, Conversely, there should be a change, taking into account for these purposes the risk of potential sanctions.

Carmen Gutierrez Toribio

social / Economist.

Head of the Tax and Financial Department

Delyser Abogados