The malpractice of the Tax Administrations and the excesses of collection must be stopped through the resources. A 70 % of the resources that interpose in certain matters are favorable to the taxpayer.

SITUATION

With the decrease in income for tax collection during the crisis, the Administration has tried to make up for this decrease through the increase in verification and inspection files. parallel, has decided to adopt a policy of "foot drag" in relation to the return of income improperly made by the taxpayer, forcing him to go to the contentious-administrative route, even, in cases in which there is repeated jurisprudence in favor of said taxpayer.

OUTCOME

In many cases, the low amount of what is claimed by the Administration, (even when what is required is legally inadmissible), motivates the administrator to pay without arguing. Especially, why, in those cases, the cost of contesting usually exceeds the amount of the debt, and although it is true that, in theory, the assistance of lawyers is not necessary to challenge settlements or tax procedures, However, the reality is that our tax system is complex and, many times, with a multitude of doctrinal and jurisprudential nuances, and with an important variability of criteria, what advises to go to a lawyer.

To this first screen by reason of the amount, they join, as deterrents when resorting to the acts of the tax administration:

- the long time necessary to obtain a final favorable resolution.

- the need to pay or guarantee the required debt, regardless of whether it is used, to avoid embargoes and executions.

Finally, and even though fortunately it is less and less frequent, there is a certain reverential fear to discuss and challenge tax resolutions, especially, by natural persons.

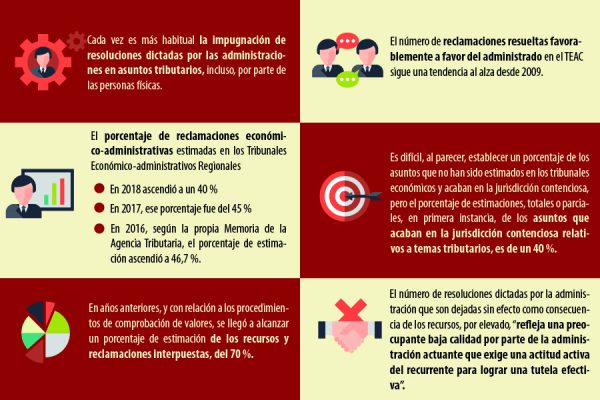

As a counterpoint to all the previous "buts", perhaps it is good to present some statistical data and conclusions drawn from the "Reports on Administrative Justice" and from the Memories of the Tax Agency itself:

There are many conclusions that can be drawn from these data. In any case, a serious problem is evident that, day by day, only seems to have a solution: the resolutions of the administrations on tax issues are in a high percentage contrary to the law, either for reasons of form or for reasons of substance, and in the face of malpractice and excess collection by the Tax Administration, it is only possible to pay or guarantee and resort on time.

Faced with the conception decades ago that tax problems were only a matter of the wealthy or fraudsters, The current perception is that the Tax Agency and the rest of the administrations with tax competencies are dedicated to "bleeding" taxpayers in a general way and that, small and medium business and the average taxpayer, are his favorite "pieces".

In this stage, the general media, not only specialized, judicial decisions related to tax issues that favorably affect a large number of taxpayers are increasingly echoed. Resolutions that are the result of the effort that many administrations have made questioning tax administrative resolutions. Recent examples:

- The ruling of the Constitutional Court of May 2017 related to IIVTNU (the call Plus Municipal value) and the impossibility of demanding the payment of said tax in those cases, -as numerous as a consequence of the crisis- in which there has been no increase in value between the date of purchase and the date of sale.

- The judgment of the Supreme Court of 03/10/2018 relating to exemption from maternity benefit in personal income tax. That of 19 February 2018 that ends discrimination against non-residents, even non-EU citizens, in the Inheritance and Gift Tax.

- The haunting dimes and diretes related to the Tax on Documented Legal Acts and the one required to pay in the mortgage loans.

TIPS

- Make the personal income tax or corporation tax declaration well advised.

- Be aware of legislative and jurisprudential changes to determine if they entail new obligations or, Conversely, allow to demand returns of amounts unduly paid.

- Act appropriately in the event of inspection or verification while these procedures last

- Analyze, once they conclude, the possibility of appealing the derived resolutions.

CONCLUSION

It is evident that there is a constitutional duty to contribute to the maintenance of public expenses, but it is also true that only according to a real economic capacity, which is what the Constitution establishes. Given the apparent neglect by the tax administrations of this limit to the tax collection, it only fits, while the tax reforms continue without arriving and the reports of the experts accumulate in the drawers, APPEAL.

Leave a Reply